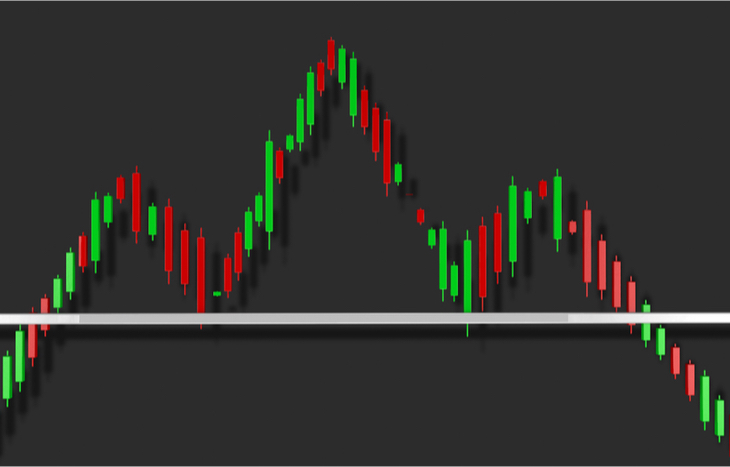

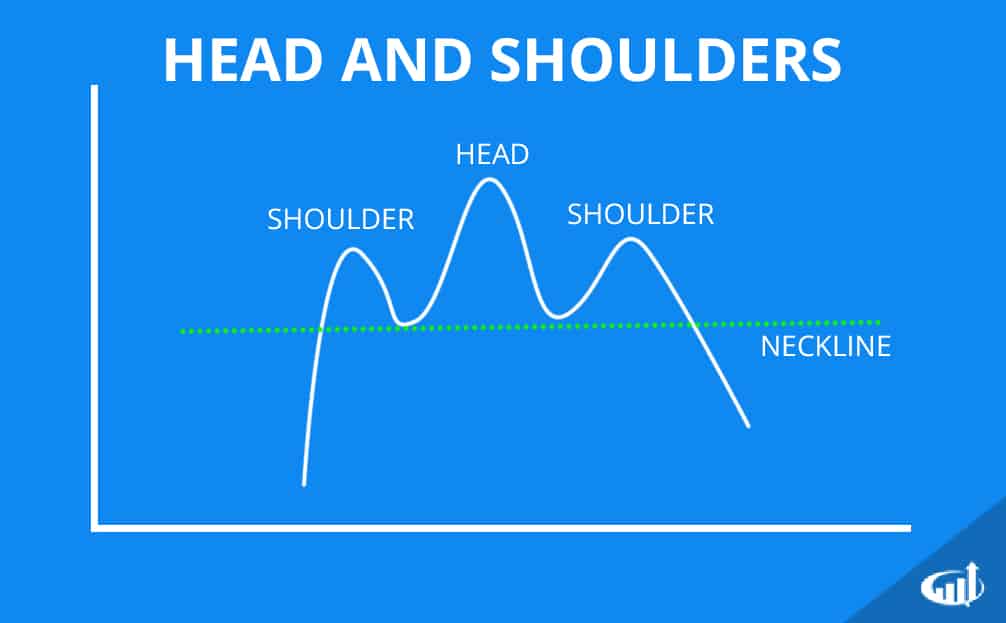

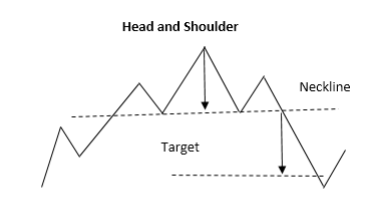

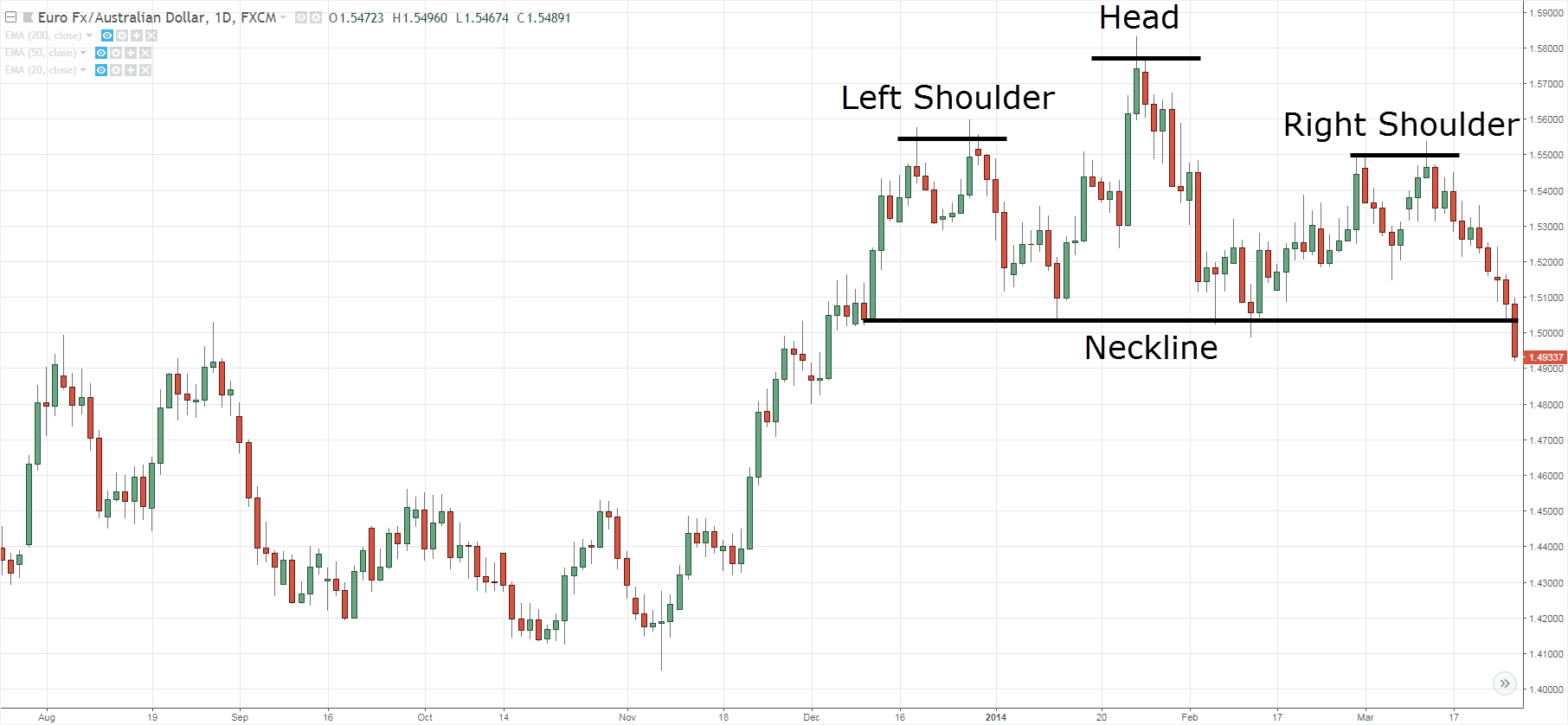

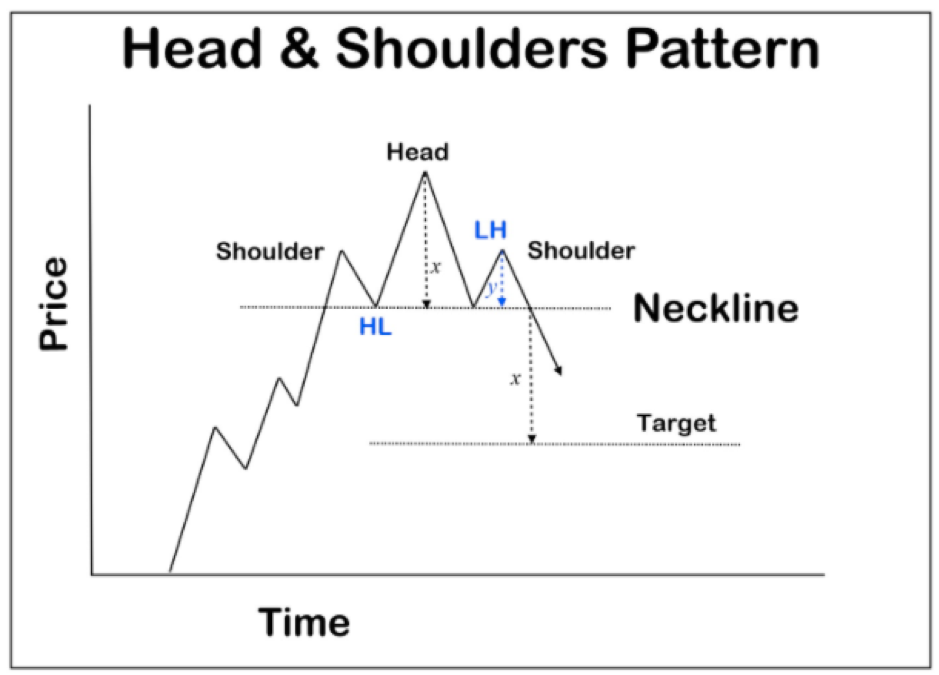

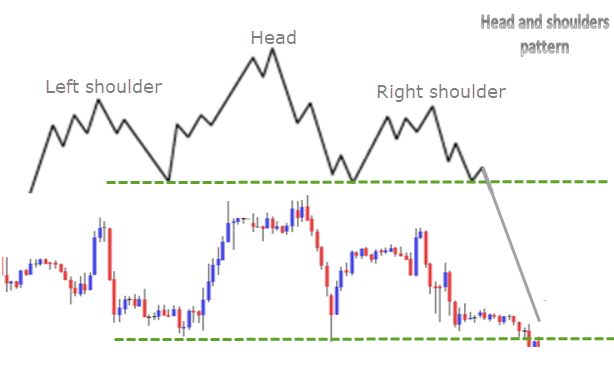

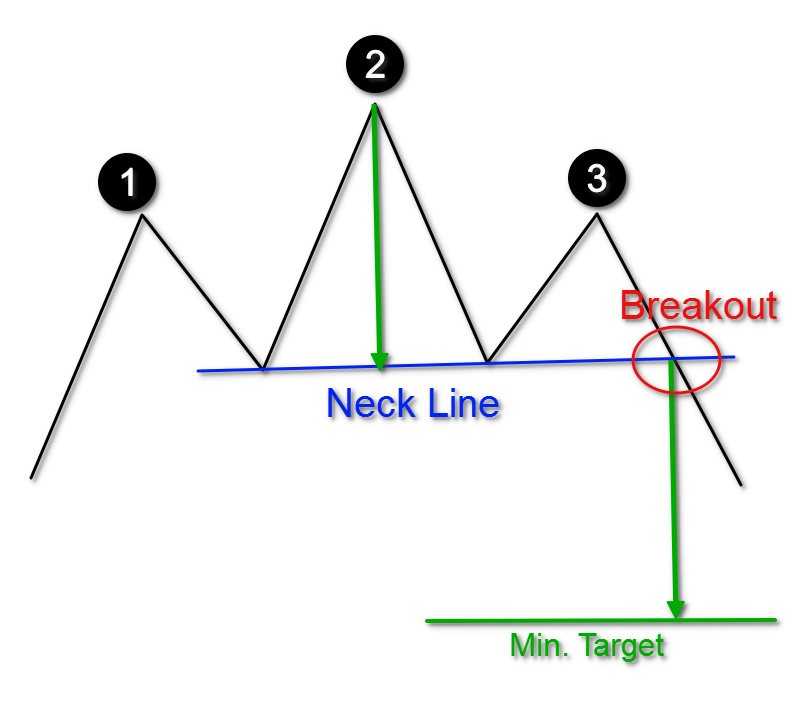

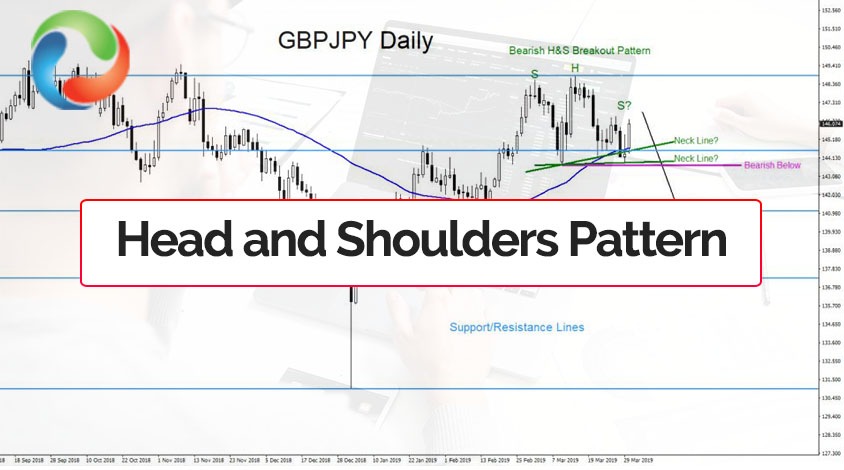

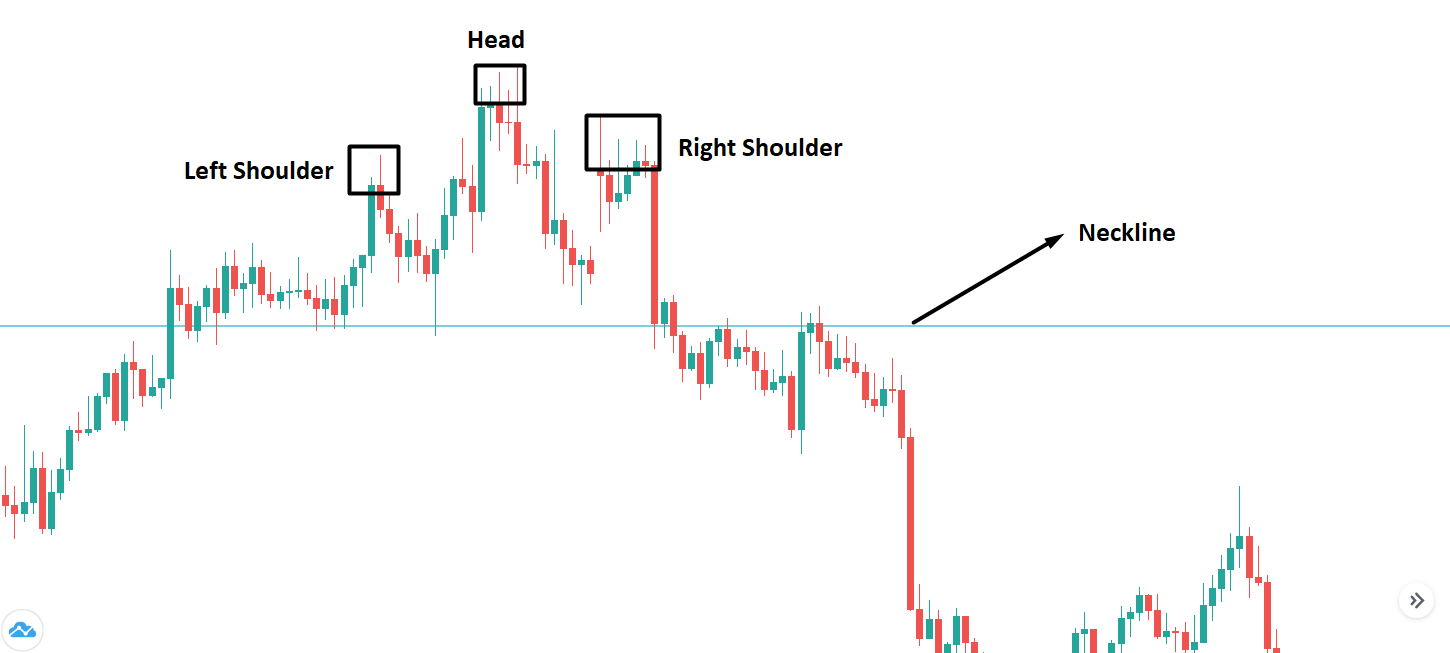

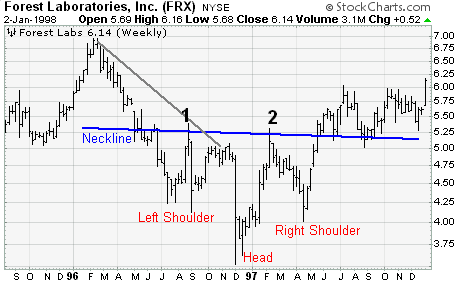

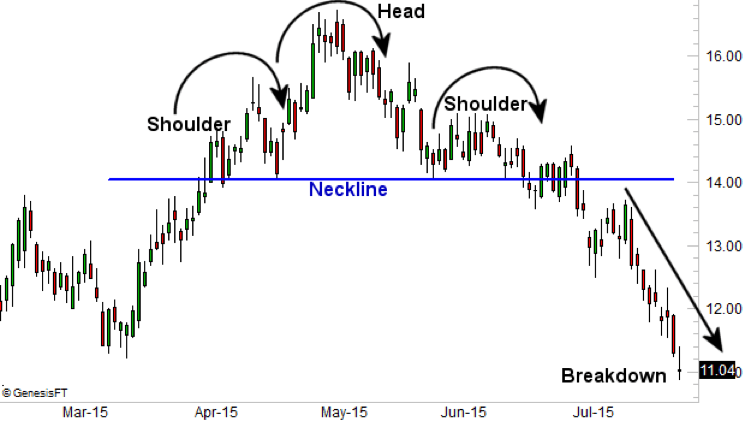

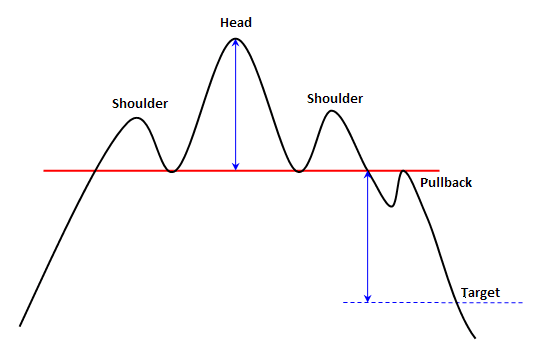

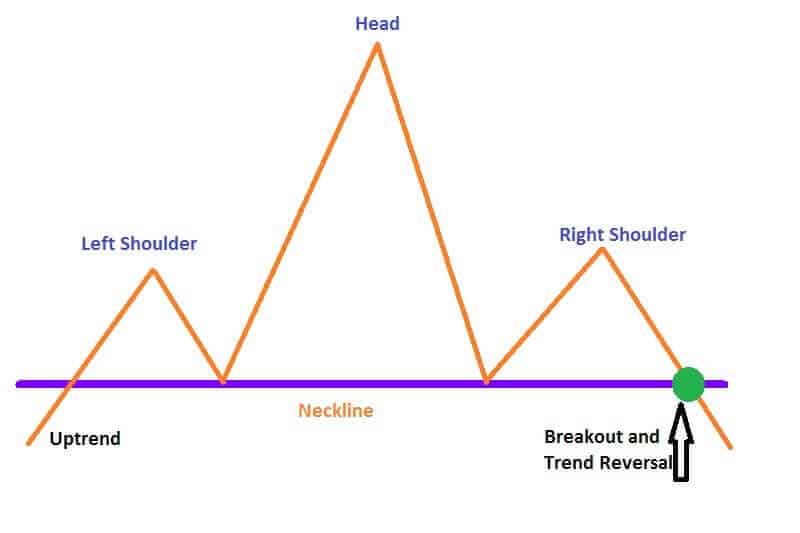

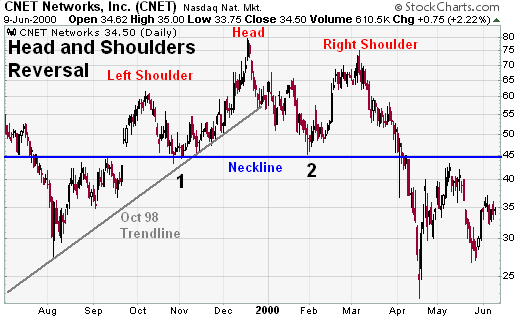

A Head and Shoulders reversal pattern forms after an uptrend, and its completion marks a trend reversal The pattern contains three successive peaks, with the middle peak ( head) being the highest and the two outside peaks ( shoulders) being low and roughly equal The reaction lows of each peak can be connected to form support, or a neckline · After breaking through $240, the head of the pattern formed around $310 Then the stock trended lower and there was little if any support when it reached the $240 level Now the right shoulder · The Head and Shoulders Pattern is a trend reversal pattern consisting of three peaks The two outside peaks are in the same height, while the middle one is the highest The pattern identifies a bullish to a bearish trend reversal and emerges in an uptrend

How To Identify Head And Shoulder Patterns When Trading

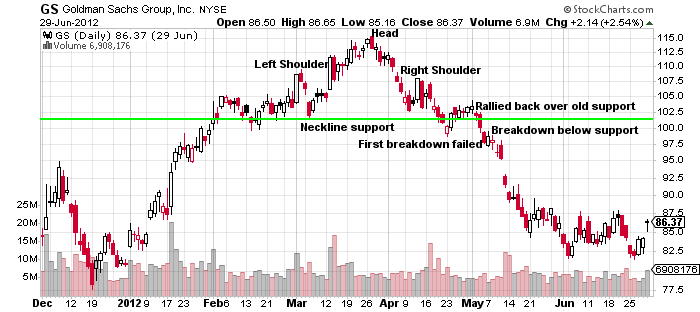

Head and shoulders pattern stock

Head and shoulders pattern stock- · If you already own a stock and believe a traditional headandshoulders pattern may be developing, identify the potential neckline when the stock is forming the right shoulder and set your sellstop price just below it For instance, if the stock retreated to $35, rebounded to a new high of $37 and then retreated back to $35 before climbingThe head and shoulders chart shows a bullish to bearish trend reversal It indicates that an upward trend is coming to a close The pattern can be used by novice and experienced traders to predict both forex and stock markets The Head and Shoulders (H&S) top pattern is composed of three peaks The two outside peaks are about the same height

Head And Shoulders Pattern Learn The Stock Market

· Basic Chart Patterns Head and Shoulders Chart Pattern This is the second post of the basic chart patterns series in which you are going to learn the complete details about the Head and Shoulders Chart Pattern and the Inverse Head and Shoulders Chart Pattern such as the formation, identification and trading strategies of these chart patterns · The Head and Shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend · The head and shoulders pattern comes in three distinct phases Each of these components comes together to indicate a trend reversal In most cases, this pattern indicates an upcoming downward trend However, it can occasionally show a reversal into an upward trend The first component is a stock price hike that comes to a peak before declining back to the base of

The Head and Shoulders pattern is one of the most popular chart patternsHowever, most traders get it wrongHere's whyJust because you spot a Head and ShoulWhat is the Head and Shoulders Reversal Pattern?The stock bounces off of the support line three times, making a head and shoulders patternOn the first shou · What is Head and Shoulders Pattern?

What is the Head and Shoulders chart pattern?The head and shoulder reversal pattern forms at the end of an uptrend, and its completion marks a trend reversal Thus, head and shoulders patterns are top reversal patterns The pattern comprises of three peaks with the middle peak (head) being the highest, and the two flanking peaks (shoulders) being lower and roughly equal · The head and shoulders pattern is a major reversal formation Typically, it takes at least two to three months to complete and sometimes much longer When a stock breaks below the neckline, there is no longer any support and very rapid declines can occur, often on increasing volume A confirmed head and shoulders formation offers an

:max_bytes(150000):strip_icc()/es-one-minute-chart-inverse-head-and-shoulders-56a22dda3df78cf77272e810.jpg)

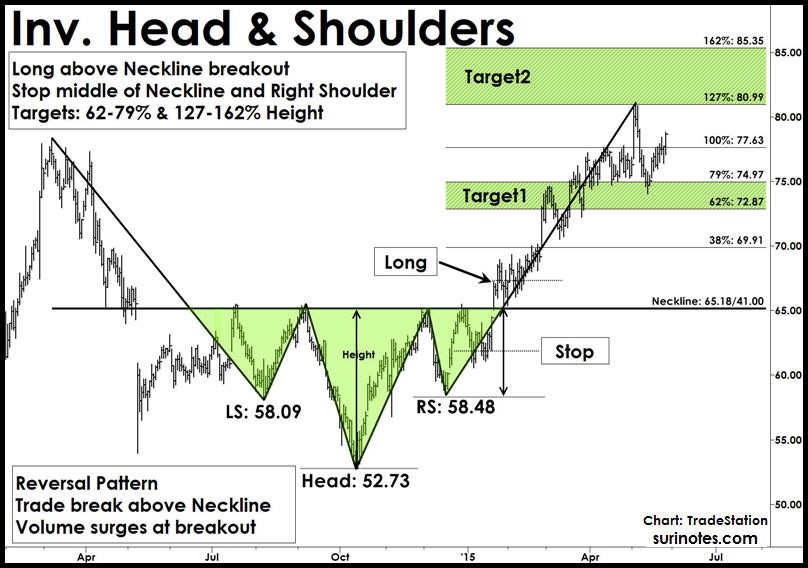

How To Trade The Inverse Head And Shoulders Pattern

Head And Shoulders Pattern A Trading Guide Cmc Markets

As a constituent of technical analysis, a Head and Shoulders pattern describes a specific chart that indicates, with varying degrees of accuracy, a possible bearish or bullish trend reversalIt is believed to be one of the most reliable trend reversal patterns available todayThe Centre Peak or the headA head and shoulders top pattern is one that has three peaks and looks like a head and shoulders because the two outside peaks are similar in height, yet shorter than the peak in the middle This pattern is typically associated with a trend reversal from bullish to bearish and is considered to be very reliable in its ability to predict this type of stock action

Head And Shoulders Pattern A Trading Guide Cmc Markets

Head And Shoulders Pattern The Head And Shoulders

About Head and Shoulders Stock Chart Pattern The same as with most of the bearish stock chart patterns, the Head and Shoulders chart pattern is based on the spotting the moment when price crosses below shorterterm support line by indicating the possibility of the formation of a new longerterm down trendOberoi reality CMP 622 Technical details 1 Stock gave a breakout above 642/43 and started trading in uncharted territory 2 Made an inverse head and shoulder before this breakout 3 Rounding bottom pattern is visible on weekly chart 4 Breakout post this rounding bottom, stock was trading in uncharted territory, followed by aHead and shoulders patterns can be used to highlight price action within a wide range of markets, including forex trading, indices, cryptocurrencies and stocks This makes it a particularly flexible and simple pattern for traders to spot on price charts

Head And Shoulders Pattern Guide For Investors Investment U

Chart Examples Of Head And Shoulders Patterns

Standard head and shoulder patterns are an indicator of a sizable downward price reversal from a prior upward trend, so head and shoulder patterns are bearish On the other hand, reverse, or inverse head and shoulder patterns indicate a bullish chart reversal from a downward trend to an upwards trendHead & Shoulders Pattern The Head and Shoulders Pattern is generally regarded as a reversal pattern and it is most often seen in uptrends It is also most reliable when found in an uptrend as well Eventually, the market begins to slow down and the forces of supply and demand are generally considered in balanceHere is an example of one stock pick with inverse type of the head and shoulders pattern This screener scans the entire US stock market so it is good to use some additional parameters for a screener You should trade only liquid stocks so include some minimum level of average trading volume to the parameter list

Learn To Identify Trade The Head Shoulders Pattern Properly For Bitstamp Btcusd By Nick Core Tradingview

Example How To Properly Sell The Head Shoulder Pattern For Fx Eurusd By Tayfx Tradingview

The head and shoulders pattern is generally regarded as a reversal pattern and it is most often seen in uptrends It is also most reliable when found in an uptrend as well Eventually, the market begins to slow down and the forces of supply and demand are generally considered in balanceThis Exide Industries Chart is a perfect example of a Head & Shoulders pattern moving into an Inverted Head & Shoulders pattern In the H&S pattern, the neckline forms a crucial support level, If the stock crosses 15 level with high volume, it can form reversal head and shoulder pattern Keep a watchHead and Shoulders Pattern in Forex The Head and Shoulders pattern is a chart figure which has a reversal character As you might image, the name of the formation comes from the visual characteristic of the pattern – it appears in the form of two shoulders and a head in betweenThe pattern starts with the creation of a top on the chart

Learn How To Trade Head And Shoulders Pattern In Forex

Inverse Head And Shoulders Chart Patterns Education Tradingview

· The head and shoulders pattern is a predicting chart formation that usually indicates a reversal in trend where the market makes a shift from bullish to bearish, or viceversa by forming shoulders at the first and third peaks and the head at the · When Head and Shoulders patterns fail, they reverse the pattern and trade in an explosive manner Most " inverse Head and Shoulders" patterns can be detected using volume patterns During the left shoulder and the beginning of the "HeadOn the technical analysis chart, the Head and shoulders formation occurs when a market trend is in the process of reversal either from a bullish or bearish trend;

/dotdash_Final_Inverse_Head_And_Shoulders_Definition_Feb_2020-01-97f223a0a4224c2f8d303e84f4725a39.jpg)

Inverse Head And Shoulders Definition

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-03-fe9a41ee5e9c497a8e135390b2caf104.jpg)

How To Trade The Head And Shoulders Pattern

Step 3) Find patterns To find patterns, we simply iterate over all our min max points, and find windows where the points meet some pattern criteria For example, an inverse head and shoulders can roughly be defined as C < A, B, D, E A, E < B, D To filter for head and shoulders with even necklines abs(BD) < npmean(B, D)*005A characteristic pattern takes shape and is recognized as reversal formationThe head is the highest point of the pattern followed by the second shoulder, which should not exceed the highs of the head The slope of the neckline is irrelevant Once the neckline is broken, then the pattern triggers the breakdown Once the support of the neckline is broken, it may act as resistance if the stock

How To Trade Head And Shoulders Tops And Bottoms

Head And Shoulders Pattern Trading Guide In Depth Trading Setups Review

· The head and shoulders is a pattern commonly seen in trading charts The head and shoulders pattern is a predicting chart formation that usually indicates a reversal in trend where the market makes a shift from bullish to bearish, or viceversaHead and Shoulders The Head and Shoulders pattern is an accurate reversal pattern that can be used to enter a bearish position after a bullish trend It consists of 3 tops with a higher high in the middle, called the head The line connecting the 2 valleys is the neckline The height of the last top can be higher than the first, but not higherReverse Head and Shoulders Pattern Stock Chart Patterns Backtest Price In a normal market will usually drop back to backtest the validity of the break up through the neckline of the Inverted Head and ShouldersThis move in prices should be on much lower volume but on rare occasions, it may not do a backtest if the markets momentum is very strong

Head And Shoulders Stock Chart Pattern

Trading The Inverse Head And Shoulders Pattern Warrior Trading

· The Head and Shoulder stock pattern defines a reversal of a stock price trend It occurs in a price uptrend and has three elements;Head And ShoulderPattern Screener for Indian Stocks from 5 Mins to Monthly Ticks All Patterns Screener Learn Head And Shoulder · A head and shoulders pattern is one of the most reliable trading pattern used in technical analysis The trend is made by three peaks with the middle being the highest The outside peaks are usually at the same level This pattern is a great indication of trend reversal of a stock or security's price In this article, we will explain in

Head Shoulder Chart Patterns Learn Why Traders Use Them So Much Commodity Com

Head Shoulder Chart Patterns Learn Why Traders Use Them So Much Commodity Com

· stock pattern Head and shoulders Head and shoulders pattern is one of the most used patterns in stock analysis, becauseofitsdistinctiveshapewhichisdevelopedbytwotrendlineswhichconverge This pattern always exists in an increase period Two valley makes the support line (or neckline) while first and third · Is a head and shoulders pattern bullish? · And the inverted head and shoulders, as you can imagine, is the opposite of the head and shoulders and it's found at the bottom of a down move This pattern is a strong bullish reversal pattern and the pattern forms when price makes a new low, then a lower low, and a higher low, making what looks like an upside down head with two shoulders

Head And Shoulders Pattern How To Identify Use It

Head And Shoulders Pattern Trading Guide In Depth Trading Setups Review

The head and shoulders pattern is a common pattern formed in stock charts and forex pair charts, signaling that a reverse of price is underway The head and shoulders trading pattern means bulls having lost conviction, and bears gaining control over the price In other words, there are more sellers than buyers, and a price reversal is imminent'Before' shot / Head and Shoulders Pattern spotted on 11/9/01 'After' shot / Head and Shoulders Pattern breakout on 9/13/01, low on 9/15/01 In this example I show a 'before' view and the subsequent 'after' view I have found the head and shoulders pattern to be one of the most reliable patterns to tradeThe head and shoulders pattern forms when a stock's price rises to a peak and subsequently declines back to the base of the prior upmove Then, the

Inverse Head And Shoulders Pattern Trading Strategy Guide

Head And Shoulders Pattern Trading Guide With Rules Examples

The Head and Shoulders Bottom, sometimes referred to as an Inverse Head and Shoulders, is a reversal pattern that shares many common characteristics with the Head and Shoulders Top, but relies more heavily on volume patterns for confirmation As a major reversal pattern, the Head and Shoulders Bottom forms after a downtrend, with its completionThe left shoulder, the head, and the right shoulder All three are price peaks, but the head is higher than the shoulders The pattern is only confirmed with volume · The headandshoulders is one of the best known and more respected trend reversal patterns on stock price charts, as it depicts a change in tide at the end of a longterm trend

The Head And Shoulders Pattern A Trader S Guide

Head And Shoulders Pattern

· The head and shoulders patterns are statistically the most accurate of the price action patterns, reaching their projected target almost 85% of the time The regular head and shoulders pattern is defined by two swing highs (the shoulders) with a higher high (the headA Head and Shoulders pattern is used in technical analysis which occurs when a massive reversal in the ongoing trend in the market happens occurs The chart pattern of Head and Shoulders is marked by three successive peaks The Left Peak or the left shoulder; · A head and shoulders pattern is a bearish indicator that appears on a chart as a set of 3 troughs and peaks, with the center peak a head above 2 shoulders more Neckline Definition

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-02-694fa56fd5aa47d4877ff9a29d669563.jpg)

How To Trade The Head And Shoulders Pattern

How To Trade The Head And Shoulders Pattern In Forex Keysoft

· Since the inverse head and shoulders are a bottoming pattern when it completes, you should focus on buying or taking long positions (owning the stock) The pattern completes when the asset's price rallies above the pattern's neckline or breaks through the resistance line

The Head And Shoulders Chart Pattern

Head And Shoulders Pattern Trading Strategy Guide

Chart Examples Of Head And Shoulders Patterns

Head And Shoulders Pattern How To Identify Use It

How To Trade The Head And Shoulders Pattern Update

A Short Explanation The Head And Shoulders Chart Pattern By Cryptotutor Medium

Keys To Identifying And Trading The Head And Shoulders Pattern Forex Training Group

Head And Shoulders Pattern How To Identify Use It

Head Shoulder Chart Patterns Learn Why Traders Use Them So Much Commodity Com

Head And Shoulders Pattern A Trading Guide Cmc Markets

Head And Shoulders Pattern Explained In Details

Head And Shoulders Pattern

Head And Shoulders Pattern Learn The Stock Market

Head And Shoulders Top Chartschool

Trading The Head And Shoulders Chart Pattern Ic Markets Official Blog

Head And Shoulders Pattern Could Lead To More Losses Learning Markets

Keys To Identifying And Trading The Head And Shoulders Pattern Forex Training Group

The Head And Shoulders Pattern A Trader S Guide

How To Identify Head And Shoulder Patterns When Trading

Head And Shoulders Pattern Trading Investment U

Head Shoulder December 0112

The Head And Shoulders Pattern A Trader S Guide

Head And Shoulders Pattern Trading Guide With Rules Examples

Head And Shoulders Pattern Interpretation With Examples

German Dax S Inverse Head Shoulders Pattern

Inverse Or Inverted Head And Shoulders Pattern Chart Patterns

:max_bytes(150000):strip_icc()/dotdash_Final_Head_And_Shoulders_Pattern_Sep_2020-01-4c225a762427464699e42461088c1e86.jpg)

Head And Shoulders Pattern Definition

Head And Shoulders Pattern A Trading Guide Cmc Markets

Complex Failed And Inverse Head And Shoulders

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_the_Head_and_Shoulders_Pattern_Jul_2020-01-d955fe7807714feea05f04d7f322dfaf.jpg)

How To Trade The Head And Shoulders Pattern

Tesla S Head And Shoulders Paints A Bearish Picture For The Stock Marketwatch

Head And Shoulders Pattern How To Identify Use It

Head And Shoulder Pattern In Trading Trading With Smart Money

Trading The Most Popular Head And Shoulders Pattern Forex Strategy Forex Academy

Head And Shoulders Pattern Interpretation With Examples

Head And Shoulders Pattern Trading Guide In Depth Trading Setups Review

How To Trade The Head And Shoulders Pattern In Forex Babypips Com

Head And Shoulders Pattern How To Identify Use It

Chart Examples Of Head And Shoulders Patterns

Head And Shoulders Pattern Trading Guide In Depth Trading Setups Review

Identifying The Head And Shoulders Pattern New Trader U

Head And Shoulders Bottom Chartschool

Important Stock Market Indices Form Bearish Head Shoulders Patterns See It Market

Inverse Head And Shoulders Pattern Trading Strategy Guide

Head And Shoulders Bottom Chartschool

Eur Usd Busted Bearish Head And Shoulders Becomes Bullish Head And Shoulders

Head And Shoulders Technical Analysis Corporate Finance Institute

The Logic Behind The Inverse Head And Shoulders Pattern Part 1

Head And Shoulders Pattern Trading Guide In Depth Trading Setups Review

How To Trade The Head And Shoulders Pattern Update

What Is A Head And Shoulders Pattern H S

Head And Shoulders Pattern How To Use Traders Paradise

93 Head And Shoulders Chart Pattern Ideas Head Shoulders Inverse Head And Shoulders Pattern

Head And Shoulders Chart Pattern Best Stock Picking Services

Head And Shoulders Chart Pattern Wikipedia

Head And Shoulders Pattern Technical Analysis Comtex Smartrend

Learn Forex A Simple Price Pattern That Can Precede Big Moves

Head And Shoulders Trading Patterns Thinkmarkets Au

The Head And Shoulders Pattern A Trader S Guide

How To Scan For Classic And Inverse Head And Shoulders Patterns Simple Stock Trading

Identifying Head And Shoulders Patterns In Stock Charts Charles Schwab

Trading The Inverse Head And Shoulders Pattern Warrior Trading

How To Trade The Head And Shoulders Pattern In Forex Babypips Com

Head And Shoulders Top Chartschool

Head And Shoulders Pattern A Trading Guide Cmc Markets

Market Outlook Is The Stock Market Making A Head And Shoulders Nysearca Spy Seeking Alpha

Head And Shoulders Chart Pattern Wikipedia

Head Shoulder Chart Patterns Learn Why Traders Use Them So Much Commodity Com

Head And Shoulders Pattern

How To Trade The Head And Shoulders Pattern In 7 Steps Stockstotrade

Head And Shoulders Pattern Trading Guide In Depth Trading Setups Review

How To Trade The Inverse Head And Shoulders Pattern

Head And Shoulders Bottom Chartschool

Reversal Patterns Testing The Head And Shoulders Pattern Mql5 Articles

0 件のコメント:

コメントを投稿